4 Reasons why Accounting is important and why we need it

1. When entering into any business activity no matter how simple it seems to be, or “Easy” it can get really messy quite fast. Just the collection of various documents can be painful if we don’t have regular procedures in place. Having the habit of collecting these documents in a monthly basis and filing them in an easy way to retrieve them in a future date if we need them can make our life so much easier and sometimes can be lifesaving (mostly penalty and fines saving to be more precise) So yes as a first point we could say that accounting can be seen as a storing/sorting documents technique. This method must be designed in a certain way so that it will make it easy for us or someone else in the future to locate any document if needed.

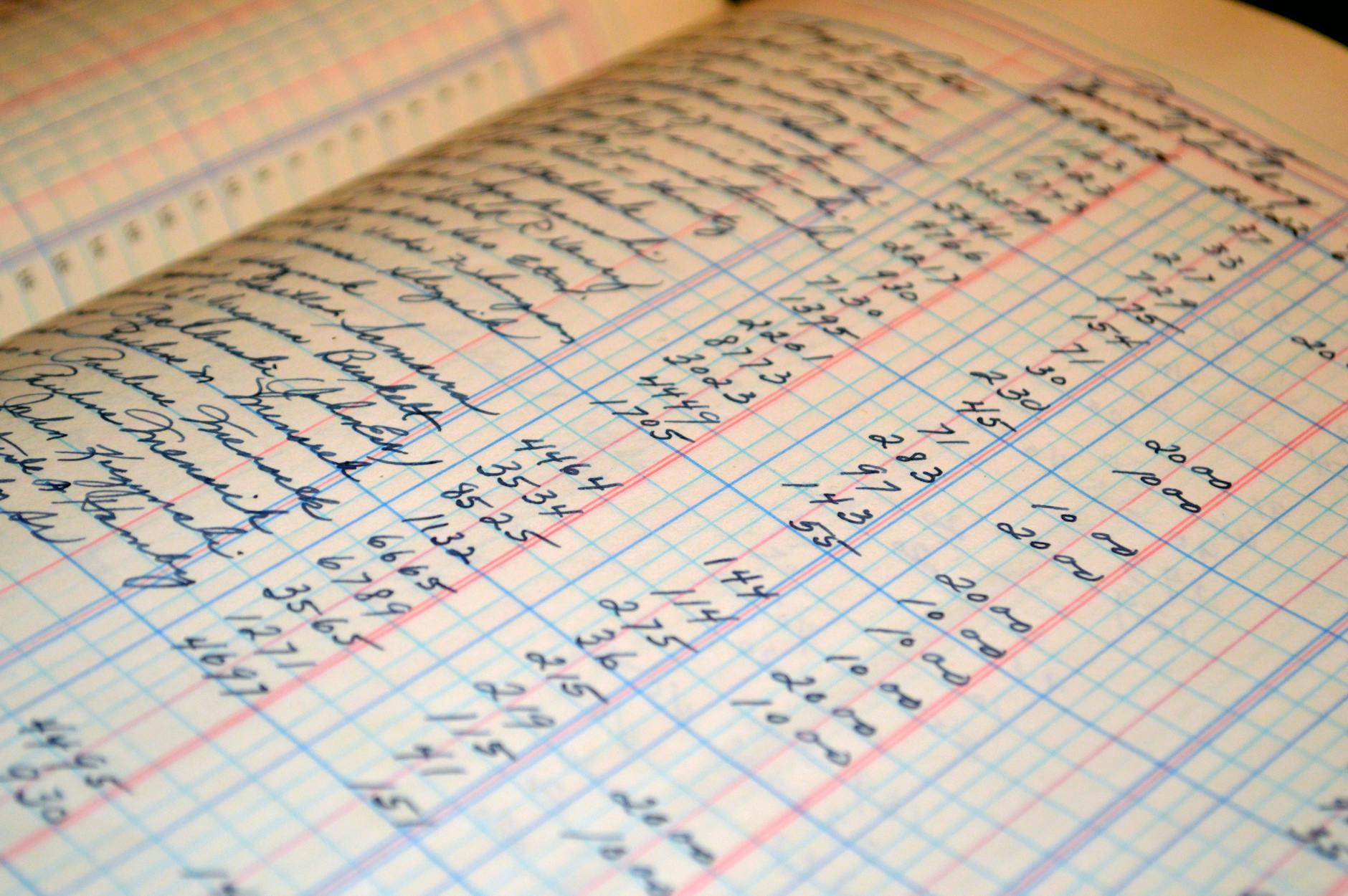

2. Bookkeeping is not just about keeping the documents in box files but also to record them in what we call “General Ledger” or “Detail Ledger” or “Journal Ledger”. Let’s take the last term since it seems to me that people outside of the world of accounting can understand it better. Imagine any person who every day before he or she goes to sleep opens her personal journal and write down what happens to her day. In a similar fashion we keep the daily financial activities of the company in a book. By doing that we can go back to any day in the past and remember what happened on that day. Imagine if you need to find out how much did you charge a certain client 4 or 5 years ago for a similar project that, you are about to offer again now. Having not recorded that transaction 5 years ago to your Journal it would have been very difficult or even impossible to retrieve this information now.

The first 2 points mainly explain what accounting is at the very basic level. So up to now you should know that bookkeeping is the process of recording the financial transactions into a book called “General ledger” or “The Journal ”. Each line of this journal will and should correspond to a document that we have stored in our box file (or electronic files nowadays). We shouldn’t have documents in that file that are not recorded in our journal or the vice versa i.e. any line in our journal that doesn’t not have a corresponding document in our box file. (Some documents could be our sales invoices, or expenses invoices such as our electricity bill, telephone, internet etc…) Now let’s explain why it’s important to have proper accounting in place.

3. The journal mentioned above will be the basis or the source of information we use to come up and build the final “face” of financial statements of any company. In general, we prepare financial statements for the users of them. But who are the users of our company’s financial statements? Well, any one with direct or indirect interest in our company. The list can be long but let’s see some of the main ones. (Shareholders in our case maybe it’s us, it can be sole shareholder or multiple, Tax authorities, major suppliers, Banks, potential investors, market researchers) Lets see how each one of them might have an interest in our financial statements.

- Shareholders: to be able to assess their performance also to be able to split their profits fairly among them.

- Tax authorities: This one is the most obvious one I think and unfortunately, we “Accountants” ended up working mainly for the tax department. We use the financial statements in order to calculate the taxes we need to pay to the government.

- Major Suppliers, It is not uncommon in cases where a big amount of an order will be placed to a supplier but the payment terms will not include immediate payment, the supplier will possibly ask to see the financial statements of a company in order to assess the repayment ability of its customer.

- Banks: when a company applies for a loan to any bank, financial statements it’s among the most important documents the bank will ask to see. The reason is the same as with the example of the supplier above but also to assess the overall risk of the company, a factor which will also affect the interest rate that they will end up using for the finance arrangement. The bank needs to know if they will be receiving their money back if they’re about to proceed with the loan.

- Potential Investors: When any investor is considering buying shares, all or some of them in any company, they will base their decision on many factors. Reading the financial statements will probably be the most important of them.

- Market researchers: Those could be university students doing some research or governmental authorities when they conduct economic research in some areas or any other group of people who have any interest in our industry.

4. Accounting goes beyond just record keeping and generating reports. Accountants are professionals that are in the core of the business world. They are making sure that the financial data are kept in order, in all possible industries and by doing so year after year they are gaining experience in reading and understanding these financial statements better than other professionals in the market. (of course, not all of them but there are some really good ones). The ones who build up the skills can move into Managerial accounting (you can of course educate yourself with a course or a degree but combining it with experience always helps) Managerial accounting is dealing with analyzing your financial data and coming up with ways to improve your profitability. Managerial accounting can focus on your own financial data or on your competitors. If your eager in learning more about managerial accounting I highly recommend exploring this article.